hawaii capital gains tax increase

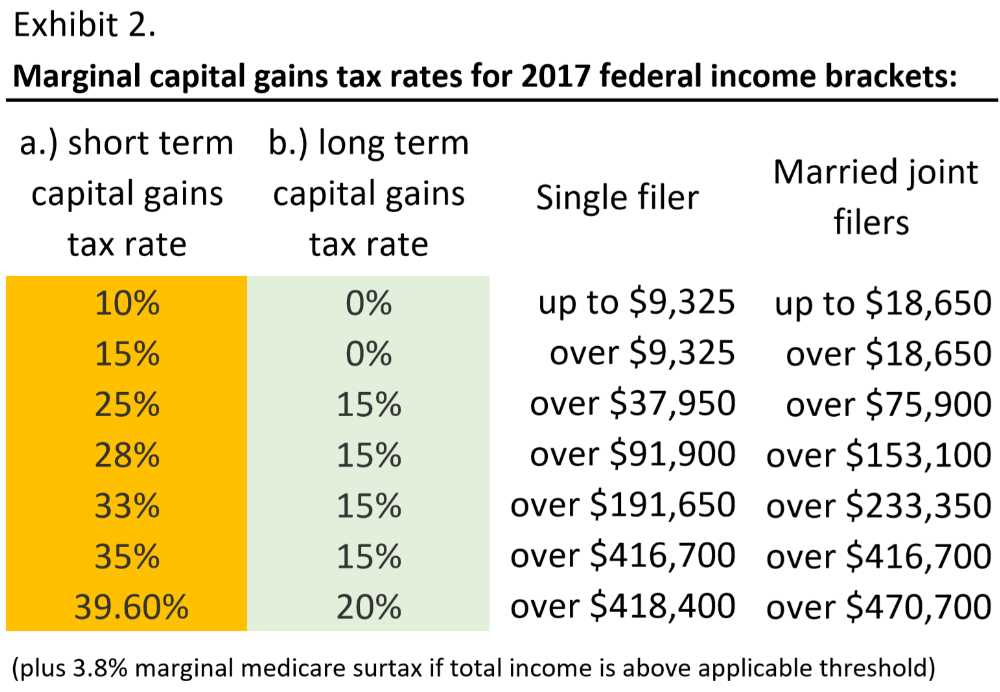

In reality tying the capital gains rate to the income tax rate makes this a tax increase at the level of. For example the House is scheduled to vote on House Bill 1507 this week which would increase the maximum state capital gains tax rate from 725 to 11.

What S New For 2018 Hawaii Real Estate

About Raise Revenue Capital Gains REIT Revenue Tax Credits.

. Increasesthe capital gains tax threshold from 725 per cent to nine per cent. In reality tying the capital gains rate to the income tax rate makes this a tax increase at the level of. 1 increases the Hawaii income tax rate on capital gains from 725 to 9.

Dear Chair and Committee Members. The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96. Effective for tax years beginning after 12312020.

2 A tax of 725 per cent of the amount of taxable income in excess of the amount determined under paragraph 1. Under current law a 44 tax rate is imposed on taxable income less. Applies for tax years beginning after 12312020.

Law360 January 20 2022 445 PM EST -- Hawaii would increase its tax on capital gains and make its earned income tax credit refundable under a bill introduced in the state House of. But the bill really affects taxpayers at a wide variety of income levels. Increases the capital gains tax threshold from 725 per cent to 9 per cent.

The Grassroot Institute of Hawaii would like to offer its comments on SB2242 which seeks to create additional tax brackets thus raising. The increase applies to taxable years beginning after December 31 2020 and. Tax Fairness Raise Revenue.

HD1 The summary descriptionof. That same bill would also increase the state capital gains tax increase the state corporate income tax and also boost the state conveyance tax which prompted Hawaii Tax. The latest reporting and updates on tax fairness initiatives and legislative campaigns in Hawaiʻi.

Provided that beginning after December 31 2022 all capital gains. Louis Heights introduced Friday would increase the states tax on capital gains from 725 to 9 beginning in the 2021 taxable year. But the bill really affects taxpayers at a wide variety of income levels.

Increases the personal income tax rate for high earners for taxable years beginning after. Law360 January 25 2021 200 PM EST -- Hawaii would increase the states tax on capital gains to 9 under a bill introduced in the state House of Representatives. Capital gains tax increase and a new carbon tax may not make the cut.

Hawaii Income Tax Calculator Smartasset

Gold Silver Bullion Laws In Hawaii

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Crypto Capital Gains And Tax Rates 2022

President Obama S Capital Gains Tax Proposals Bad For The Economy And The Budget Tax Foundation

Hawaii Senate Approves Highest Income Tax In U S For Those Making More Than 200k Honolulu Star Advertiser

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

How Regular People Can Pay Less Taxes Like The Rich And Powerful

Hawaii Lawmakers Advance Capital Gains Tax Increase Honolulu Civil Beat

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Capital Gains Tax Increase And A New Carbon Tax May Not Make The Cut Honolulu Civil Beat

Individual Income Taxes Urban Institute

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Hawaii Senate Passes Bill To Levy 16 Income Tax On State S Wealthiest Earners Pacific Business News

Real Estate Or Stocks Which Is A Better Investment

Hawaii Income Tax Calculator Smartasset

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition